GfK, a global leader in market & consumer intelligence, released insights and key trends that have shaped the tech & durables market during the festive weeks in 2021. The insights reveal the purchase pattern of customers in 2021 vs 2020 during the weeks before, during, and after Diwali and Dussehra.

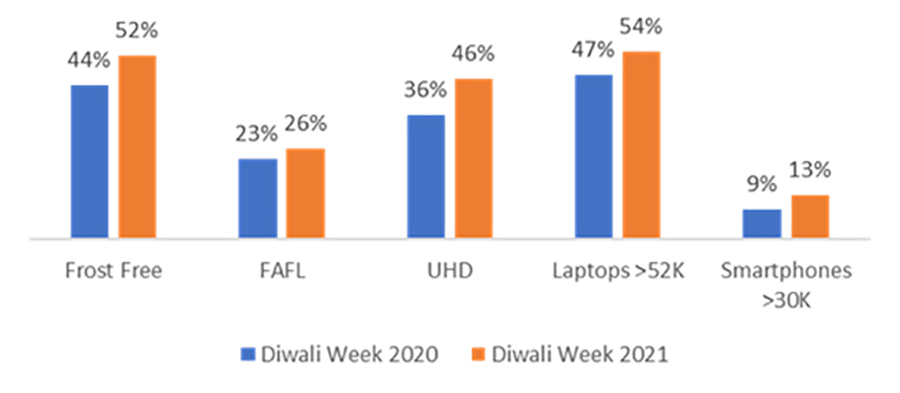

The industry has witnessed heightened consumer sentiment during the festive weeks. The surge during Diwali week (1st – 7th Nov) was higher this year, complemented by the increased contribution of premium segment across key tech & durable categories like ACs, Washing Machines, PTV, Smartphones, mobile computing, and cooling devices.

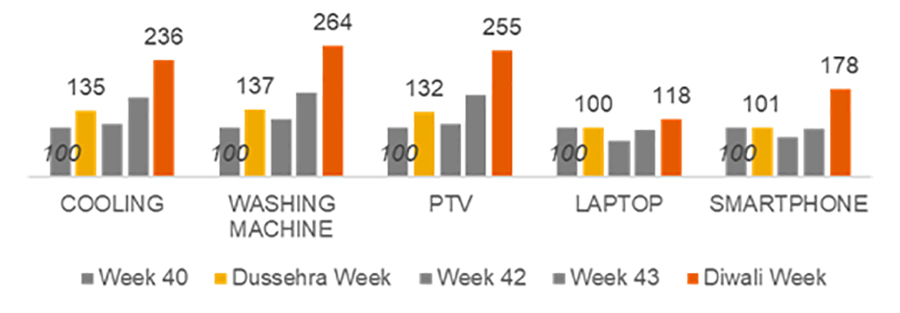

As per GfK Weekly Index that accounts for 30-35% of total organized offline channel, while Dussehra week accelerated the consumer sentiments and sets up the festive platform, the run-up to Diwali week held the key to overall market performance. Indexing against week 40 (4-10 Oct) revealed healthy performance by most categories. Numbers indicated the much-anticipated Diwali build-up in 2021 was strong.

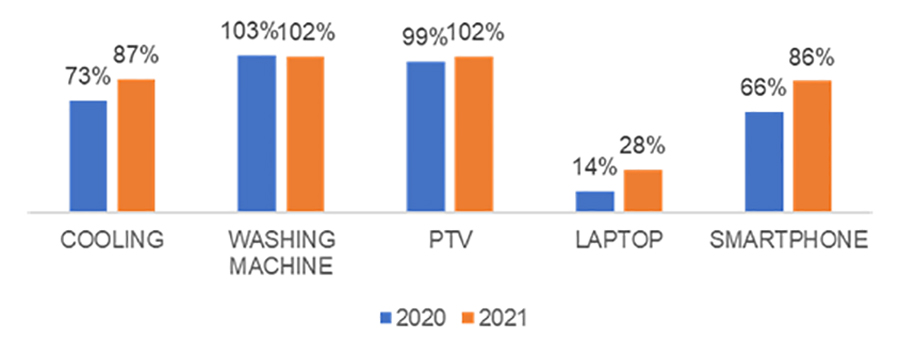

Most white goods categories witnessed increased traction during Diwali week. A comparison of Diwali week sales with the average of the previous four weeks revealed that most product groups surpassed the Diwali week surge of the past year.

Volume Growth - Diwali week vs. Average of previous 4 weeks

The Data represents– 2021: Week 40:4th – 10th Oct; Week 41:11th – 17th Oct (Dussehra week); Week 42:18th – 24th Oct; Week 43: 25th – 31st Oct V/S Week 44:1st – 7th Nov (Diwali week)

2020: 12th – 18th Oct; 19th -25th Oct; 26th Oct -1st Nov; 2nd -8th Nov V/S 9th – 15th Nov (Diwali week)

Dheeraj Mukherjee, Head of Sales – India, GfK says, “In the month of Oct ’21, we witnessed an upsurge in premiumization trend leading to double-digit value growth for electronics and appliances whereas smartphones accounted for high single-digit value growth compared to Oct ’20. Within the offline channel, we witnessed the premiumization trend continued driving the value growth, which maintained the positive momentum in 2021 vs 2020.”

Online channel witnessed a contribution surge during the pre-Diwali month across major product groups. Consumer demand for bigger and better products has tuned up further this Diwali. Notably, the highest contribution increase is witnessed in PTV followed by refrigerators.

Sharing insights on the Diwali week sales, Mr. Mukherjee further added, “GfK Weekly Index representing organized channel point-of-sales data reveals that with promotions during the first week of Nov ’21 (Diwali week), consumer electronics and appliances registered 80-100% value and volume growth over average weekly sales in Oct ’21.”

_525_860.jpg)